What impact will coronavirus have on the real estate market?

On March 11, 2020, the World Health Organization (WHO) officially designated the coronavirus and COVID-19 (the respiratory illness it causes) a pandemic. Cases have occurred in 114 countries and resulted in approximately 120,000 infected people and more than 4,000 deaths.

Although the statistics and the ways the illness affects individuals’ lives are rapidly changing, we’ve taken a look at how the outbreak is impacting U.S. domestic real estate markets up to this moment.

A Summary of Related Economic Events

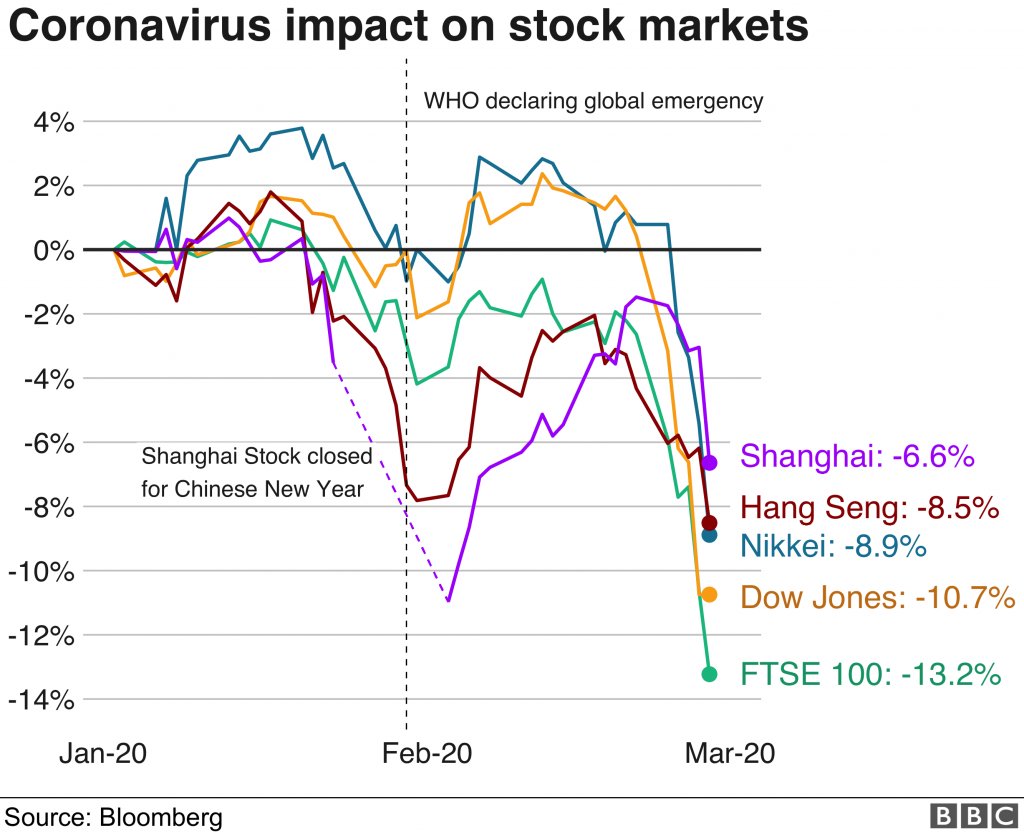

- Since the WHO declared a global emergency on Feb. 20, 2020, major stock indices around the world have dropped an average of more than 9 percent. The Dow Jones Industrial Average suffered its largest single-day drop in history on Feb. 27, 2020.

- The travel industry is sustaining significant losses. Major conventions are being canceled, and large companies are discouraging non-essential travel. More than one-third of business travel in 2020 may be lost.

- On March 15, 2020, the Federal Reserve cut its benchmark interest rate to 0 percent and announced plans to buy at least $700 billion in government and mortgage-related bonds. This happened less than two weeks after the Fed cut the benchmark rate by 50 basis points to just below 1.25 percent.

- On March 6, 2020, Congress passed a bipartisan $8.3 billion coronavirus bill that includes $3 billion for developing coronavirus treatments, $2.2 billion to help stop its spread, and more than $1 billion to aid efforts overseas.

- Mortgage rates have dropped to three-year lows, to approximately 3.5 percent at the time of this post.

- Overall U.S. growth may drop to below 2 percent in the first quarter, and lost global output due to the virus could amount to $2.7 trillion.

- On March 13, 2020, President Trump declared a state of emergency, which is expected to make $40-50 billion available to address the outbreak.

Will Economic Volatility Caused by Coronavirus Impact Real Estate?

Despite what many people believe, there isn’t a direct connection between stock market performance and real estate values. It’s the overall health of the economy (which prior to the events of the past two weeks, was still considered relatively strong) that ultimately affects them both. As long as consumers feel confident about their jobs and income, they will continue to spend—and that includes buying real estate.

Among other things, the strength of the real estate market is impacted by treasury bond prices, which are correlated to mortgage rates. When the stock market and other asset classes start to see a lot of volatility, investors will move their cash to bonds for stability and security. As demand for treasury bonds increases, however, bond prices go up and their yields (the interest they pay investors) fall. And that pulls mortgage rates down, too.

It’s worth noting that the catalyst for today’s economic situation is very different from the 2008 financial crisis, which was directly caused by issues in the sub-prime lending market. During that recession, sub-prime mortgages were bundled up and sold for much more than they were worth. Ultimately, real estate speculators let homes financed by these mortgages go into default, and these bundles of mortgages—called credit default swaps—lost most of their value, bankrupting large investors and starting a domino effect that rippled through all aspects of the economy.

Contact Miami Property Management, LLC

Learn more about what’s happening in the local rental market or speak with us about our property management services by clicking here.

Leave a Reply

Want to join the discussion?Feel free to contribute!